Like quite a few things, this journey owes it start to the collapse of FTX.

The news about the platform's potential insolvency dropped on a Sunday midnight, so I just shrugged it off to go to sleep. But when I woke up and saw that nothing had been resolved, I just had this feeling in my gut and started pulling funds out.

Now, look. I've been trying to get into trading all that time, with very little results. Charting was so boringly esoteric and nothing was making sense.

But FTX? It felt like I was on auto-pilot.

I just found myself pulling funds out or I found myself taking a short on Solana.

And of course, that short made money.

In the sluggish haze of that weekend, I kept thinking about that trade.

I’ve been struggling to trade this entire time. But if I can make money trusting my gut . . . what if I just focus on leaning into my intuition?

I mean, hey, the last time I actually made money was shorting $LUNA. And I also shorted without really thinking about it.

The charts clearly weren’t working, so what if I throw the whole brain away and tried to make more unconscious trades?

So I’ve had some progress with trading on that front. I’m still learning, but writing has been helpful in further unlocking learning.

And since have been asking, here are some lessons from learning how to trade.

The goal

Your goal in trading is to find what makes you confident, and avoid the things that make you lose money.

Why confidence? I got it from this interview of bitbit for this line: “[b]uilding confidence in a trader is the most challenging aspect of trading.” I first read that when I knew I didn’t have confidence, and it just felt like the right pursuit.

There are so many ways to skin the cat, so be open-minded. I spent too long thinking I needed to get better at charts or financial analysis. But that wasn’t making me money, narratives and momentum was bringing in the bag. You’re in crypto, try everything at least once.

Leverage and creating practice conditions

DO NOT TOUCH LEVERAGE IF YOU’RE JUST TRYING TO MAKE MONEY QUICKLY. PEOPLE TALK WHEN THEY’RE WINNING BUT NOT WHEN THEY GET LIQUIDATED.

For a more interesting take: leverage can be a risk management tool. I owe a lot to this thread by @Panterra0x, go read it. That one really had me do a double take because I had never seen anyone else talk about leverage in that manner.

In application, use leverage to create practice conditions. You can try paper trading, but it won’t teach you how to handle your emotions. Instead, I am repeating the advice to take a small amount, and then portion it on leverage.

Example: if you have a $10,000 portfolio, you can take $1000 and run it on 5x leverage to mimic $5000. You’re practicing with size that’s equivalent to half your portfolio, but if you get liquidated, you only lose $1000.

This is also a good way to limit your exposure on centralized exchanges and DeFi. Considering how funds can be trapped or hacked, I think there’s a lot of value in understanding leverage like this. Like do half in an exchange, half in cold-storage. Lend for points, borrow for more points, but keep what you borrowed in your wallet in case of hacks.

You’re going to suck. That comes with learning something new. Fence off your practice funds, and either you lose it all or you don’t.

Trading is easy, the mental part is not

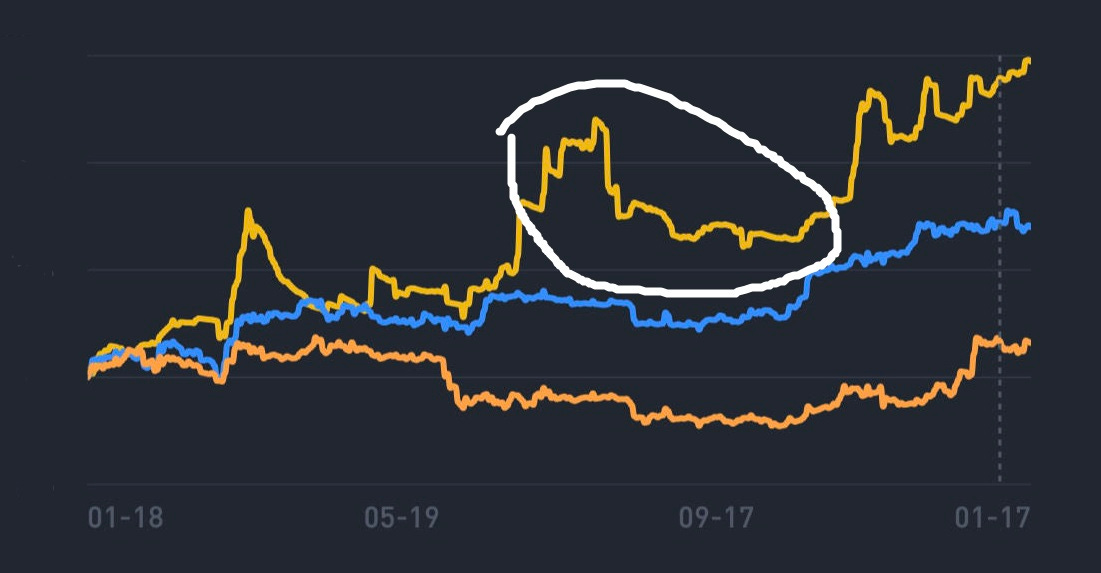

Size up earlier, size down if you’re late. A string of small wins can inflate your confidence, then you size up way too big, and then you’re stuck holding a losing trade. Welcome to the fucking valley of despair (see below).

Don’t trade your PNL. If I figure out how to break out of this, I’ll let you know.

There’s always another trade out there. And there’s always going to be something that you missed, but there’s something that comes along that you’ll know exactly how to play. It’s the latter that matters.

Strong coins stay strong. It was a beginner mistake to target top gainers for shorts when they’ll end up surging again another day.

“in discretionary / the right position / is almost always flat / the right action / is almost always do nothing / 5x yr there's free money on the floor / pick it up then do nothing / outperformance” - mgnr

Alternatively: cash is a also a position. Sometimes the best trade is to go on a little vacation and keep your winning streak at a win.

Don’t forget to journal. I was doing terribly trying to stick to pen and paper or a tool, but I found myself sticking to a semi-public Telegram channel. It’s been good to just jot your thoughts down and then review it.

Useful tools

Binance and Bybit liquidation tape (t.me/nanceliqtape)

Spreadfighter - I really love their liquidation maps

Alpha Mail - 80+ interviews with traders, lots of little things to absorb

Going into 2024

I’ve progressed but also feel like I’ve regressed.

Two common problems:

I can’t bring myself to hold spot or a position for longer periods of time. I know it stems from holding spot last cycle and not properly selling. God knows how you’re supposed to get over seeing your portfolio shrink like that, because I clearly haven’t.

Either I see someone else talking about it or somehow get validation from someone else—I would not do anything on anything I thought of.

And I bet the answer to 2 would be to do more of 1, right? But I don’t hold for longer because I don’t trust myself; a cycle.

Feels like an impasse. Fake it ‘til you make it, but internally feels I’ve just been running on mediocre luck more than ever.

Other than aggressive internal gaslighting, the only way to figure out the confidence thing is to practice again. Fingers crossed I get it together by the end of this year.

And to end: CJ and AV, thank you, always.